WhatsApp)

WhatsApp)

Mining and exploration, oil and gas as well as renewable energy and utility ... Export and Import Levy (EXIM) 24 Import duty exemptions 24 Administrative charges 24 Advance Eco levy 24 Export duties 24 Excise duties 24 Excise tax stamp 24 Environmental tax 24 Airport tax 24. 2 | Navigating taxation Income liable to tax In Ghana, income tax is ...

First, note that goods arriving in the country may be subject to import duty, special duty, VAT and import excise duty. Ghana import duty is assessed based on volume, weight or value of an item, and is subject to change every year. Import duty rates range from 0%, 5%, 10% and 20%, and the fees are collected by the Ghana Customs Division.

Mining and upstream petroleum companies pay CIT at a rate of 35%, while companies principally engaged in the hotel industry pay a reduced rate of 22%. The CIT rate for companies engaged in nontraditional exports is 8%, while banks lending to the agricultural and leasing sectors pay a CIT rate of 20% on income from those businesses.

The Zambian minister however revealed that the government was forced to impose the tax after realizing that mining firms had stopped local production of copper concentrates but were just importing ...

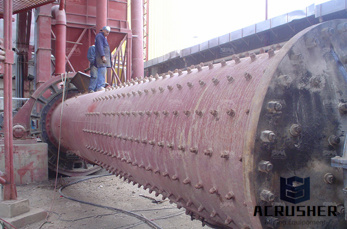

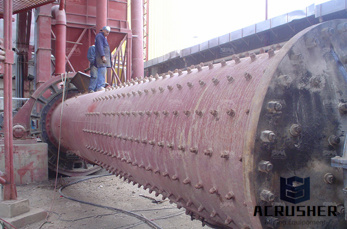

import duty mining equipment ghana MC Machinery. Import Duty Mining Equipment Ghana iaSuknie . Working as a team with partners in france, the netherlands, ghana, ivory coast and team consists of a ghs west legon agric mechanization generator sets heavy duty equipment industrial equipment mining equipment ghs 0302 224793, 221916, .

Aug 11, 2007· The import license system was abolished in 1989, but a permit is still required for the import of drugs, communications equipment, mercury, gambling machines, handcuffs, arms and ammunition, and live plants and animals. There are no controls on exports. Ghana .

Customs VAT, customs duty, Duty 12B (Ad valorem excise duties on imports) Table and table show the customs value of imports, customs VAT, customs/import duties and excise duties on imports by sector. "Machinery and mechanical appliances, electrical equipment.

The Mining and Manufacturing Industries in Ghana are legally required to train individuals on lifting equipment, under Ghana''s Mining regulations. There are important safety rules for the operation of lifting equipment which should be employed by all concerned with operating, supervising or supplying work place transport.

The taxable value (tax base) of taxable supply (standard rated) for VAT purposes is the service charge or the sales value plus the % National Health Insurance Levy (NHIL) and the % Ghana Education Trust Fund Levy (GETFL) applicable on the supply. The taxable value for NHIL and GETFL is however calculated on the sales value of the invoice.

The mining sector has therefore been an important part of Ghana''s economy, with gold accounting for over 90% of the sector. The mining sector has produced 4,313,190 ounces of gold, which is the highest ever in the history of the country, resulting in export revenues of more than billion.

ghana mining equipment import tax MTM Crusher Alcohol, Meat Imports killing Ghana Cedi Business Peace FM. 25 Feb 2014 More than GH¢1 billion was spent importing mining equipment and about Authority (GRA ...

What would be the import duty for buying a sports equipment ( a ping pong robot) that is bought in china and shipped to USA. the robot is less than 500, is it free (as in no duty) for personal use? If there is a duty then how much would it be approx, i read around 30% on one of gov sites

Ghana: Mining Laws and Regulations 2020. ICLG Mining Laws and Regulations Ghana covers common issues in mining laws and regulations – including the mechanics of acquisition of rights, foreign ownership and indigenous ownership requirements and restrictions, processing, beneficiation – .

Maple Mining Services (MMS) is an indigenous, heavyduty equipment and mining services company. MMS provides high quality earth moving equipment for rental to the mining, civil and agricultural sectors in Ghana and West Africa. We provide .

PwC Corporate income taxes, mining royalties and other mining taxes—2012 update 3 as "ring fencing". The Ghana government, in the 2012 Budget Statement, proposed an increase to the corporate income tax rate from 25% to 35% and an additional tax of 10% on mining companies. Ghana''s proposed tax increases are likely to take

Ghana mining guide . Executive summary . Ghana presents a number of opportunities in the mining sector, especially in the gold industry. It is the second largest gold producer in Africa, after South Africa and 10th largest globally. The other important mineral resources are oil, diamond, bauxite (used in the manufacturing of aluminum), and ...

Generally, all goods imported into Australia are liable for duties and taxes unless an exemption or concession applies. There are exclusions and restrictions to the use of the concessions. Use these pages to find out more about the cost of importing goods and how it is calculated.

Jun 19, 2020· Ghana has a long history of mining, especially for gold. Gold is a precious metal of high monetary value, sought after for the production of coins, jewellery, and other artefacts. It is a fact, evidence by records over the years, that gold is a major foreign exchange earner for Ghana''s socioeconomic development.

Import Duty: 9%. Threshold: USD 800. NY, United States. Avoid issues at customs. Knowing all costs upfront and clearly communicating with your customer how it will be paid will result in a smoother shipping experience. Learn more about import duties and taxes Start shipping to Destination with us.

The levy is collected by the Domestic Tax Revenue Division of the Ghana Revenue Authority through VATregistered persons in the same way that VAT is collected. ... The value for charging VAT on imports is the value for customs duty plus import duties and other taxes which may be chargeable. ... mining (as specified in the mining list) and ...

Ghana Mining Industry Equipment Ghana Oil and Gas Customs, Regulations Standards ... Goods arriving in the country may be subject to import duty, Value Added Tax (VAT), special tax and import excise duty. Duties are imposed on certain categories of exports also.

Import Duty Ghana HomePage resource for News Sports . ... The global average import duty rate for Mining equipment is 3 1 with a minimum of 0 and a maximum of 35 when classified as الأعمال التجارية والصناعية → أدوات الآلات الصناعية الحجر والأخشاب → طحن وتلميع آلات ...

The global average import duty rate for Mining equipment is %, with a minimum of 0% and a maximum of 35%, when classified as الأعمال التجارية والصناعية → أدوات الآلات الصناعية | الحجر والأخشاب → طحن وتلميع آلات الحجر والاسمنت والزجاج, with WTO tariff subheading Edit

Created Date: 10/22/2015 9:52:52 AM Title: Ghana Renewables Readiness Assessment Keywords: International Renewable Energy Agency, IRENA, IRENA publication, renewable ...

WhatsApp)

WhatsApp)